The global asset management and investment sector is an indispensable component of the world’s economic footprint, making it integral that the industry is accurately assessed and monitored to maintain a financial equilibrium.

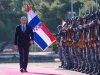

LUXEMBOURG INVESTMENT FUND INDUSTRY SPOTLIGHT

The scope of international asset management and foreign direct investment (FDI) has become increasingly significant in the global financial sphere in the past 20 years. The majority of this growth is stimulated by rising demand in the extension of mutual and private funds, in the face of ever-changing financial conditions which have subsequently heightened the need for investment guidance.

The beginnings of the investment and asset management industry first emerged in the 18th century, due to an increase in organised borrowing activity. Therefore, through the support of national banks and governments across Europe, savings products such as life insurance and pension funds began to conceptualise towards the end of the century.

Today, with nearly 5,000 fund and asset management companies operating in Europe, the continent is a financial hub for global banking operatives. This is conducive to the overall efforts of the European financial services industry, which has endeavoured to build a stable and informative environment for international investors, facilitated through easy access to trustworthy information and advice.

Within the context of the investment fund industry, the main function of the investment promotion sector, and investment promotion agents (IPAs) more specifically, is to create an investment promotion strategy (IPS) for a particular region. This is achieved by a clear understanding of the socio-political and economic landscape of the given country, as well as knowledge of the nation’s international economic policy in order to navigate and encourage FDI.

An IPS exists as a balance between a country’s business competitiveness and attractiveness as a location, alongside the intentions of the international investor. Therefore, great care and precision is taken when formulating an IPS, as it must correlate with certain political, economic, and environmental criteria. Therefore, this highlights a need for accurate representation

and guidance, whilst showcasing the given region’s investment opportunities on the world stage.

ASSOCIATION OF THE LUXEMBOURG FUND INDUSTRY (ALFI)

Interview: As key support for the Luxembourg fund industry, Director General Camille Thommes tells us how ALFI bolsters the sector to be properly equipped to serve the domestic market and international clients. In the context of constant transformation in the financial industry, ALFI provides major support to the country’s investment fund sector, positioned as the face and voice of the country’s investment promotion activities.

Q&A WITH CAMILLE THOMMES, DIRECTOR GENERAL, ALFI

Firstly, can you talk us through the origins of ALFI, including how it was established and the initial vision?

Camille Thommes, Director General (CT): ALFI began in 1988 when Luxembourg was the only country to have implemented the first European investment fund directive (UCITS1). The feeling at the time was to create a dedicated association that could promote and represent the Luxembourg investment fund industry.

Since inception, how has ALFI progressed in terms of its key objectives and the messages it tries to get across?

CT: As we celebrate our 35th anniversary this year, we have come to represent approximately 1,500 investment funds, asset management companies, and service providers that form a key part of the fund value chain. The latter includes central administrations, transfer agents, depositary banks, law firms, and consultancy firms, each providing indispensable services to our industry.

The main mission of our association is to lead industry efforts and provide solutions to our members, promoting Luxembourg as the most attractive fund centre. Derived from this main mission are three key objectives; the first is to help our members capitalise on emerging industry trends and utilise the broad legal toolbox.

Secondly, we strive to shape regulation by providing our views on any legislation emanating from the European authorities, as well as other global economic bodies such as the International Organisation of Securities Commissions (IOSCO).

The third objective is to encourage and further enhance the professionalism and integrity of industry players, whilst advocating for the Luxembourg investment fund industry on the international stage, which is achieved through ALFI roadshows and conferences.

We are consistently reviewing these objectives (that are linked to our strategic vision embodied in the ALFI Ambition Paper 2025), by developing a comprehensive plan after a change in the chairmanship of the association. This ambition paper considers new trends, developments, opportunities, and challenges that will be affecting the industry going forward.

“The main mission of our association is to lead industry efforts to make Luxembourg the most the most attractive international centre for investment funds”

Camille Thommes, Director General, Association of the Luxembourg Fund Industry

Following this, what excites you most about the investment fund industry in Luxembourg currently, and what is your place in this field?

CT: Over the last 30 years, we have become the face and voice of the investment fund industry in Luxembourg. The simple fact that we exist and continue to grow demonstrates the extent to which we play a relevant role as the main interlocutor between the industry and public authorities. These include the Ministry of Finance, the regulator, and other major public stakeholders. Consequently, I believe our positioning has certainly helped us grow to a prominent role in the European industry.

ALFI’s impact and international reach is also supported by our roadshows that we have been organising for over 20 years in markets around the world in which our members distribute their products and offer their services. Our very first roadshow was held back in 2005 in London, and from there more were added each year. Last year, we organised a total of 52 roadshows, conferences, and expert briefings.

At a national level, we run approximately 200 working groups in which members contribute to our advocacy work on existing and forthcoming regulation as well as develop guidelines and best practices on topical subject matters. Therefore, as an open forum of discussion, the association creates a fruitful ecosystem of experts and practitioners.

What are the biggest challenges currently facing ALFI?

CT: The challenges facing the association are the same ones affecting the entire asset management industry.

Locally, as an association, we need to remain vigilant, not rest on our laurels, and keep on striving for improvement. We constantly work on enhancing our legal toolbox, which comprises the investment vehicles and legal structures most relevant to our clients and investors. In addition, we monitor developments in key distribution markets, so that we can effectively support our membership in their business activities.

Most importantly, we need to ensure the competitiveness of our industry, given its economic impact for the country.

What makes Luxembourg the best place for international investment?

CT: The success that Luxembourg has achieved has not been built overnight; it took years to develop. Historically, we gained a competitive advantage due to the early transposition of European directives into national law.

Other valuable reasons why Luxembourg is the best place for international investment include our diversified ecosystem, as well as a multicultural and multilingual environment.

Furthermore, Luxembourg is continuously developing its legal toolbox. Recent successful examples of this include the reserve alternative investment fund (RAIF) and the limited partnership structure, which specifically cater for the needs of alternative asset managers.

As a country, we enjoy having fiscal, social, and political stability. As such, we welcome international investors seeking to set up a base in and operate out of Luxembourg in a professional and sound regulatory environment.

Finally, Luxembourg ranks high in terms of security, quality of life, and is one of the best countries in the world for attracting talent.

What trends are currently transforming the asset management and investment sector and how are you responding to them?

CT: Transformation occurs through a constantly evolving regulatory environment, representing both challenges and opportunities.

The challenge is to accurately manage the increased workload by ensuring calibrated and proportionate regulation.

Sustainability in finance is a crucial topic, as the asset management industry can be a significant contributor in helping to transition to a greater climate-friendly global economy, and act as a key player in allocating resources to sustainable businesses as well as cultivating growth in the green economy.

Another promising opportunity can also be found in the retailisation or democratisation of private assets, as it is more commonly known. This change represents a significant development not only for Luxembourg, but the European industry as a whole, and opens up private assets in an adequate framework for investors who wish to allocate part of their savings into long-term projects.

Going forward, the increasing pressure on margins and costs will further drive consolidation in the industry.

How do you see ALFI and the asset management and investment industry developing over the next five years, and how will you navigate these changes?

CT: As an association, we continuously need to demonstrate our relevance through our daily work, by supporting our members in providing investors with investment solutions and helping them achieve their long-term goals.

Secondly, the financial sector has an important role to play in the transition to a more sustainable global economy and in achieving our net zero ambitions. The general interest of both institutional and retail investors in sustainable products is clear and growing. It is up to the collective management industry to step up the educational work in the interest of supporting the transition through sustainable investments.

We support and encourage financial education initiatives to raise the general public’s awareness of the need to increase knowledge on personal finance and the economy in general.

An important focus of ALFI is to further raise awareness of the need for increased diversity across the financial services industry. ALFI commits to respecting and promoting the principles of non-discrimination, pluralism, and developing diversity in our sector.

Overall, even though we operate in a volatile economic environment, I am convinced that the asset management industry can provide important advice and financial solutions to end investors and manage their long-term savings adequately.