A major shift in global gas pricing in recent months has seen Asian spot prices fall to close to British wholesale levels for the first time in nearly five years, bringing more liquefied natural gas (LNG) back to the UK and leaving the country well positioned to capitalise on any further shift in global supply flows.

The UK’s growing import dependence means that it is increasingly connected to global gas price fluctuations. As the most liquid and deep gas market in Europe, and having plenty of regasification capacity, the UK has gradually taken on the role of global ‘sink’ and market of last resort for LNG.

This flexibility meant that the UK bore the initial brunt of LNG cargoes being diverted away from Europe to Asia in 2011. Following the Fukushima disaster in Japan the country’s electricity utilities ramped up LNG purchases to replace lost nuclear generation following the nation-wide nuclear shutdown.

From a high point in 2011 of 25.5 billion cubic metres (the equivalent of around 30 percent of total gas demand), LNG imports into the UK slumped to below 10 billion cubic metres in 2013 as cargoes were diverted to higher priced markets.

Asian gas prices had to rise significantly in order to attract LNG spot cargoes away from markets in the Atlantic Basin. And although the UK’s liquid market was easily able to replace LNG volumes with alternative pipeline supplies from Norway and its own domestic production, it served to put a firm floor on British wholesale gas prices.

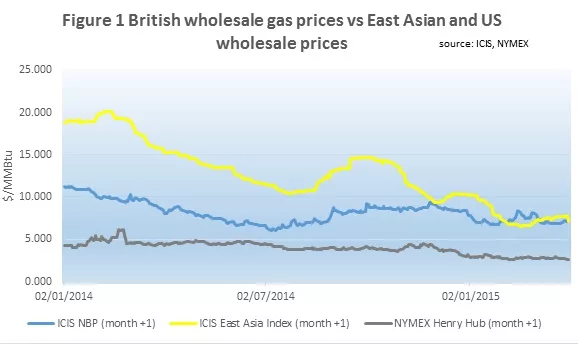

After reaching close to $20/MMBtu last winter, however, spot LNG prices in East Asia have tumbled by more than 50 percent. This is a result of a combination of weaker demand signals in key Asian economies, more global LNG production and lower oil prices, which have all impacted regional buying sentiment.

Oil prices still directly determine the price of the majority of long-term LNG contracts in East Asia, albeit on a lagged basis. Therefore, the decline in crude prices has allowed Asian buyers to nominate more on those contracts, and this in turn has put downward pressure on spot prices.

The regional demand downturn was such that the ICIS East Asia Index (EAX) – an average of LNG spot price assessments for Japan, South Korea, Taiwan and China – fell below the equivalent ICIS front month contract at the UK’s NBP in February for the first time since May 2010.

With Asian and European spot prices now trading close to parity, the flexible Qatari and Atlantic Basin LNG that had been diverted to markets east of the Suez Canal has already begun to come back to markets in Europe.

The UK was one of the only European countries to register a rise in LNG imports last year, climbing by more than a fifth to 11.50bcm. But this trend has accelerated as the UK picked up surplus cargoes. There have been 26 LNG deliveries to UK regasification terminals in the first three months of the year, nearly three times as many deliveries in the comparable period last year, according to the ICIS Edge shipping platform.

This additional LNG available at the margin, combined with weaker winter demand, has been a major factor in the softening of British wholesale prices over the winter, with Q1 2015 NBP front month prices averaging around 30 percent less than last year, according to ICIS data.

And with the risks of Russian gas supply disruptions to Europe this winter now beginning to fade, the expectations of a more benign global price environment over the next two or three years may provide some indications as to the future UK market direction.

After a four year hiatus, a wave of LNG production has started to enter the global gas market. Around 35 million tonnes– around 49 billion cubic metres– of liquefaction capacity is scheduled to come online this year alone, principally from four Australian projects, but also from the first of the US LNG export schemes in the Gulf of Mexico. A similar ramp-up of capacity from Australia and the US is expected in 2016 and 2017.

While the majority of the volumes from the Australian projects have already been locked into long-term contracts with buyers in East Asia, the uncertainty over the pace of economic growth in China and the knock-on impact on demand levels in Japan and South Korea has raised questions over how much LNG the region will be able to take in, particularly with the prospect that some nuclear reactors may be in a position to restart from the second half of 2015.

There are new LNG importers, such as Egypt and Pakistan, that may be able to pay a premium for flexible cargoes, but the established and new Asian markets may not be in a position to absorb the surplus LNG. This means that, for the likes of Centrica and E.ON, both of which have flexible supply contracts with Qatar, the UK could prove a more attractive LNG import option through 2015 and 2016, or at least a more viable market of last resort than has been the case in previous years.